Solar loan interest rates have hit an all-time low, but what does that mean for you?

If you are like 46 percent of homeowners in the United States, you have considered switching to solar panels. However, the upfront costs of a new system might make you hesitant or decide to put it off for another year.

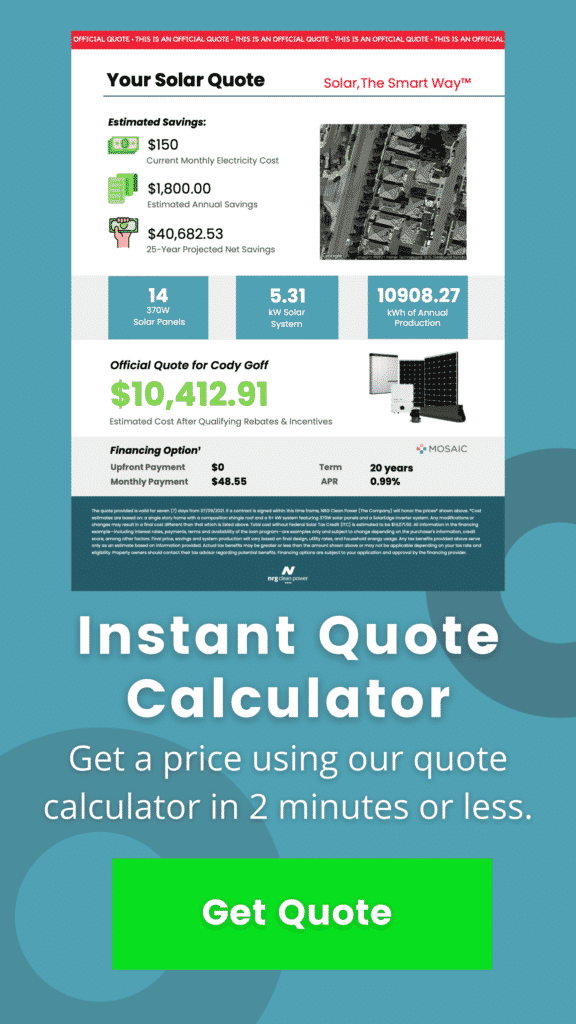

What you might not realize is that there are lenders who provide loans specifically for putting in these sustainable systems—and their solar loan interest rates are lower than ever before. Combined with tax breaks which apply to both the loan itself and the installation costs and the fact that the cost offsets in electricity bills, you can end up saving a lot of money.

2021 Solar Loan Interest Rates

Statistically, homeowners can now find solar loans with lower interest rates than ever before. However, regular factors still come into play. Interest rates, of course, will vary by your credit and the duration and type of loan you choose. But some lenders are offering an unprecedentedly low APR of just 1.49 percent. That’s due, in part, to the Federal Reserve lowering its interest rate that it charges banks to nearly 0 percent in order to boost the economy, making this an ideal time to take out a loan.

Why did the Federal Reserve do this?

The overall goal is to promote a healthy economy and the rate change does this by helping control inflation. This encourages higher employment rates and ensures reasonable interest rates by private lenders. The Federal Reserve may change rates based on several factors. These include: signs of inflation, economic forecasts or even in response to a major event that affects the economy. In this case, the rate changes come as a direct response to the impact of COVID-19.

“We are deploying these lending powers to an unprecedented extent [and] … will continue to use these powers forcefully, proactively, and aggressively until we are confident that we are solidly on the road to recovery,” Jerome Powell, chair of the Federal Reserve Board of Governors, said in April 2020.

That said, this isn’t the only factor contributing to this sweet spot in the solar market that homeowners find themselves.

Federal Solar Tax Credit

Before December 2020, the solar investment tax credit (ITC) was set to drop from 26 percent to 22 percent. However, the recent $1.4 trillion federal spending package alongside the $900 billion COVID-19 virus relief spending bill included extended renewable energy tax credits. The ITC will stay for two more years. As a result, commercial and industrial solar projects that begin construction before December 31, 2022, will still receive a 26 percent tax credit.

This brings the cost of solar down by over a fourth and makes installing solar panels that much more accessible. This doesn’t even consider the record-low interest rates.

Rising Costs of Electricity

Another driving factor of the overall affordability of going solar in 2021? Rising costs of electricity for homeowners across the country. Not only are homeowners seeing drastic rate increases from their utility companies, their electricity consumption has spiked as well.

Work-From-Home Drives Costs Up

42 percent of the U.S. labor force now works from home full-time. Another 33 percent are not working—a testament to the wide-sweeping impact of the lockdowns. While the remaining 26 percent—mostly essential service workers—work in-office or on their business’ premises. Just based on numbers alone, 2021 United States is a work-from-home economy. Almost twice as many employees work from home compared to those at work.

Experts expect electricity consumption to increase by about 8 percent, according to the U.S. Energy Information Administration’s Short-Term Energy Winter Outlook. Households that use electricity for heating are expected to spend an average of $1,209 on electricity bills—a 7 percent increase—this winter. And in California, residential energy use during the pandemic has risen 15 percent to 20 percent over the same period last year.

Working from home means increased usage which means higher electricity bills for homeowners like you.

Utility Rate Increases

The average Southern California Edison residential customer’s electricity rates will increase from 18.1 cents/kWh to 20.7 cents/kWh which is a 14.4 percent increase. Pacfic Gas and Electric customers should expect to see a 12.4 percent increase in electricity rates going into 2021.

Why Go Solar Now?

Considering the extremely low solar loan interest rates available in response to the economic fallout of COVID-19, the extension of the ITC, increases in residential electricity consumption due to work-from-home policies, and utility rate increases across the country (with drastic increases in California), there is no better time than now to go solar.

Contact a solar provider like NRG Clean Power to get the best prices and most competitive financing options for your solar project!

Authored by Ryan Douglas

NRG Clean Power's resident writer and solar enthusiast, Ryan Douglas covers all things related to the clean energy industry.