Fast facts (in 30 seconds)

- Not refundable: It can zero-out your federal income-tax bill, but never turns into a cash refund.

- 30 % through 2032: The credit stays at 30 % of qualified costs until December 31 2032, then steps down to 26 % in 2033 and 22 % in 2034.

- Carry-forward allowed: Any unused amount rolls to future returns for as long as the credit exists. irs.gov

1. What exactly is the Residential Clean Energy Credit?

The Residential Clean Energy Credit—often still called the “solar tax credit”—lets homeowners deduct a percentage of the cost of solar PV, battery storage, geothermal, small wind, fuel cells and solar water-heating systems from their federal income taxes. There is no cap on how much you can claim, and eligible labor, permitting and interconnection fees count toward the basis.

Rate schedule at a glance

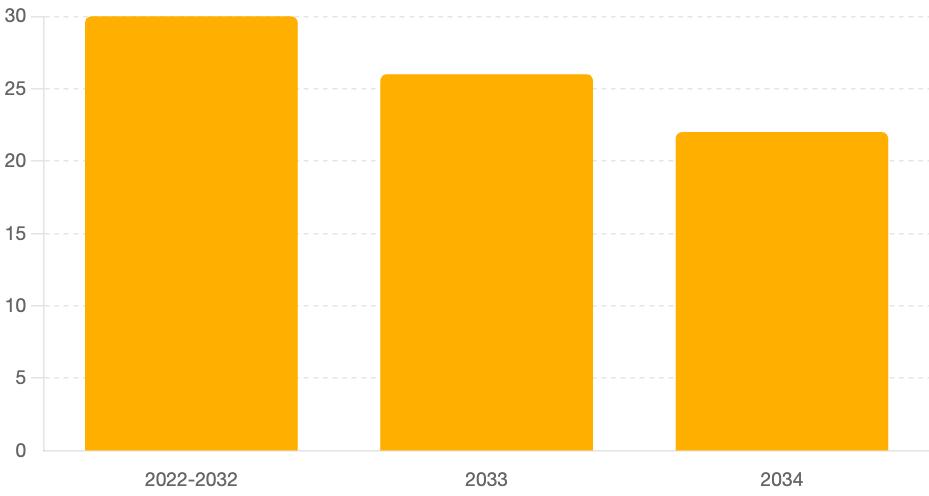

Residential Clean Energy Credit Percentage By Year (Credit Percentage (%) by Year Placed in Service)

| Year system is placed in service | Credit percentage |

|---|---|

| 2022 – 2032 | 30 % |

| 2033 | 26 % |

| 2034 | 22 % |

| 2035+ | Expires (unless Congress extends) |

(Need the big-picture rules first? Check our full explainer on the federal solar tax credit for eligibility, covered equipment, and filing steps.)

2. Refundable vs. Non-Refundable Credits—Why It Matters

| Term | What it means | Example |

|---|---|---|

| Refundable | Generates a cash refund if the credit is bigger than your tax liability. | Earned Income Credit, Premium Tax Credit. |

| Non-refundable (the solar credit) | Reduces your tax bill to $0 but stops there; excess is not paid out. | Owe $2,000, credit is $5,000 → $0 tax due, $3,000 carried forward. |

Because the solar credit is non-refundable, you need enough tax liability—this year or in future years—to fully absorb it. irs.gov

3. How the Carry-Forward Works (With Real Numbers)

Rule of thumb: File Form 5695 every year until the credit balance is gone.

| Scenario | Year 1 | Year 2 | Year 3 | Outcome |

|---|---|---|---|---|

| Big install, modest income | $18 k solar + battery → $5,400 credit. Tax due = $2,500 → $2,900 carried forward. | Tax due $2,000 → $900 left. | Tax due $1,200 → credit fully used. | No value lost; it just took 3 years. |

| High-income homeowner | Same $5,400 credit. Tax due = $15 k → entire credit used in Year 1. | – | – | Finished. |

There is no statutory limit on how many consecutive years you can roll the credit forward, provided Congress keeps the underlying credit alive. (The current statute runs through 2034.) irs.gov

4. Smart Ways to Use a “Non-Refundable” Credit

- Time your install wisely

- If you know a bonus, stock sale or Required Minimum Distribution will push up your taxable income next year, scheduling the install then can maximize first-year use.

- Adjust paycheck withholding

- Lower your W-4 withholding after the install so you don’t overpay and then “wait” for the credit to offset next April.

- Pair with truly refundable incentives

- Many state rebates or utility performance payments are cash-back programs that don’t affect the federal credit calculation.

- Add battery storage later (if budget is tight)

- A standalone battery installed in 2025 still qualifies for the 30 % credit, creating a second bite at the apple.

5. Filing in 2025: Checklist & Form 5695 Tips

| Step | What to do | Why it matters |

|---|---|---|

| 1 | Gather paid invoices, contract, and “placed-in-service” documentation. | IRS requires costs be incurred and system operational in the tax year. |

| 2 | Complete Form 5695, Part I. | Line 5 shows any carry-forward from 2024; lines 1-4 list new costs. irs.gov |

| 3 | Transfer the credit to Schedule 3 (Form 1040), line 5. | That’s where it offsets your income-tax liability. |

| 4 | Keep receipts and the signed interconnection letter for at least three years after the credit is used up. | Standard IRS record-retention window for credits. |

💡 Pro tip: If you refinance a solar loan, the refi costs (points, interest) are not eligible for the credit.

6. Frequently Asked Questions

Does adding a second array reset the 30 %?

Yes, each new qualifying project gets its own 30 % calculation in the year it’s placed in service.

Can landlords claim the credit?

Not under the residential credit. They must explore the Business Investment Tax Credit under IRC §48.

What if I sell my home before using the full carry-forward?

You keep it. The credit is attached to you as the taxpayer, not the property.

Will Congress make it refundable?

No proposals are active as of June 2025. The last major change (Inflation Reduction Act, 2022) kept the credit non-refundable.

7. Key Takeaways

- The solar tax credit is a powerful 30 % incentive, but it only offsets taxes you actually owe.

- Unused amounts roll forward until they’re gone, so plan for multi-year use if your tax bill is low.

- File Form 5695 accurately, save documentation, and coordinate with any state or utility programs for maximum total savings.

Ready to go solar?

NRG Clean Power designs, installs, and services high-efficiency solar + storage systems across California and Texas. Get a free quote today and let our experts ensure you capture every dollar of the Residential Clean Energy Credit.

(This article is for educational purposes only and is not tax advice. Consult a qualified tax professional for your specific situation.)