California’s solar property tax exemption is a big deal. It keeps property taxes from increasing when you add solar panels—meaning you get the benefits of a higher home value without the extra tax burden. That’s a win.

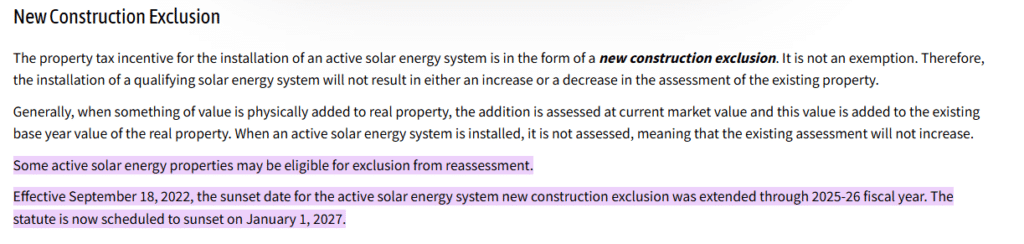

The law lives in Section 73 of the California Revenue and Taxation Code. It’s been tweaked and extended over the years, but the core idea remains: encourage more people to go solar by removing a potential financial roadblock.

Without the exemption, installing solar could mean higher property taxes, making it a tougher sell for homeowners. That’s not what California wants.

That said, the exemption is nearing its deadline and it is better to get solar installed now rather than wait expecting an uncertain extension.

When Will California’s Solar Property Tax Exemption Expire?

The clock is ticking. Right now, California’s solar property tax exemption is set to expire on January 1, 2027. It’s been extended multiple times before, showing the state’s long-standing commitment to solar energy. But will it happen again? That’s where things get complicated.

The most recent extension came through Senate Bill 1340 (SB 1340), which Governor Gavin Newsom signed into law in September 2022. This bill pushed the exemption deadline from January 1, 2025, to January 1, 2027. Before that, the exemption had been renewed several times since its original passage in 1980 under Proposition 7—a clear sign that lawmakers have historically prioritized keeping it in place.

Key Deadlines to Know

- Solar systems completed before January 1, 2027, qualify for the exemption, meaning they won’t trigger a property tax reassessment.

- If your system is under construction by January 1, 2026, you’re still eligible—as long as the installation is fully completed by the January 1, 2027, deadline.

- There’s no rule saying when construction must start—it just has to be finished by the cutoff date to qualify.

Will the Exemption Be Extended Again?

That’s the big question. Historically, the answer has been yes—multiple times. But the landscape is shifting.

When Governor Newsom signed the most recent extension Senate Bill 1340 (SB 1340), he added a notable warning: “This policy has a direct impact on property tax revenues that support essential services at the local level.” Essentially, cities and counties rely on property taxes for funding schools, emergency services, and infrastructure.

By keeping solar systems tax-exempt, the state is reducing the property tax revenue that would normally be collected from homeowners with upgraded properties.

So, while another extension could happen, it’s far from guaranteed. California is still pushing aggressive renewable energy goals, but lawmakers may decide that other incentives (like direct rebates or different tax structures) are a better approach.

What this Means for Homeowners and Businesses

If you’re thinking about going solar, waiting isn’t a great plan. Right now, the tax exemption is locked in through 2027, but that might be the last extension.

The safest move? Get your system installed before the deadline so you can lock in your tax savings while they’re still available.

How to Qualify for California’s Solar Property Tax Exemption

It’s pretty straightforward. Here’s what you need:

- An active solar energy system (most rooftop PV systems qualify).

- A completion date before January 1, 2027.

- The system must be owned, not leased.

- The exemption applies to both homes and businesses.

For most people, the exemption applies automatically. But just to be safe, check with your county assessor—some require a claim form to ensure it’s correctly applied.

For official details on how this works, including legal guidelines and FAQs, check out the Active Solar Energy System Exclusion on the California State Board of Equalization’s website.

The state defines an active solar energy system as one that collects, stores, or distributes solar energy. It has to be thermally isolated from living spaces, which is a fancy way of saying it can’t just be a passive part of the building.

If it heats your pool or hot tub? Nope, doesn’t count.

How to Claim the Solar Property Tax Exemption in California

It’s mostly automatic, but it doesn’t hurt to double-check. Here’s what to do:

- Confirm that your system qualifies under state guidelines.

- Contact your county assessor to see if any paperwork is required.

- If necessary, file the appropriate claim form.

- Keep records of your system—installation date, specs, receipts—just in case.

Again, most of the time, this happens without you lifting a finger. But a quick check with your local assessor’s office can ensure you’re not leaving money on the table.

Application Process for California’s Solar Property Tax Exemption

How you claim the exclusion depends on whether you’re installing solar on a property you already own or buying a home with a system already in place. You must also be sure to use California solar installers that are licensed and qualified to work in the state – to avoid any red tape.

For Existing Property Owners

Adding solar to your current home or business? Good news—you probably won’t have to do anything.

No paperwork. No forms, no applications. The county assessor gets a copy of your building permit and applies the exclusion automatically.

Check your assessment. If your property taxes go up after installing solar, call your county assessor’s office—they might’ve missed it.

For New Property Buyers

Bought a home with solar already installed? You’re not off the hook just yet.

File a claim. You need to submit Form BOE-64-SES (“Initial Purchaser Claim for Solar Energy System New Construction Exclusion”). Send it to your county assessor as soon as possible after closing. Don’t wait.

Why? Because if they reassess your property value before your claim is processed, your tax bill could temporarily go up.

County-Specific Scenarios

Same law, different counties, different quirks.

San Luis Obispo County

Covers buildings completed on or after January 1, 2008. If you ever need to cancel the exclusion (not common, but possible), they provide specific instructions.

Fresno County

Sends out a solar permit questionnaire to property owners adding solar. If you’re buying a home with solar, you must file Form BOE-64-SES signed by the buyer to get the exclusion.

San Francisco County

You don’t even have to ask. They automatically send exemption applications to new property owners.

Kern County

Officials aren’t thrilled about the exemption because it shifts some tax burden onto other property owners. So, while they follow state law, they’re keeping an eye on it.

Special Considerations

Large-Scale & Utility Solar Projects

It’s not just for rooftop panels—utility-scale projects also qualify. But if a solar facility has a 50-megawatt or larger capacity and is owned by an electrical corporation? State-assessed. Doesn’t qualify for this exclusion.

Change in Ownership & Solar Tax Exemptions

The exclusion sticks until the property changes hands. If there’s a sale, reassessment happens—including the solar system. This is critical for mergers and acquisitions in the solar industry. If a company buys a solar project, it needs to be structured right to avoid reassessment.

Partnership Flip Transactions

These are common financing setups for solar projects and, if structured correctly, they don’t trigger a reassessment. But one misstep? That tax break could disappear.

California Solar Tax Credit vs. Property Tax Exemption: What’s the Difference?

Both incentives put money back in your pocket, but they do it in completely different ways. One reduces the cost of going solar upfront, while the other saves you money year after year by keeping your property taxes down.

How the Property Tax Exemption Works

The property tax exemption prevents your home’s assessed value from increasing when you install solar panels. Normally, home improvements that add value trigger a reassessment—which leads to a higher tax bill.

Under California’s Active Solar Energy System Exclusion, solar installations are treated as if they don’t exist for tax purposes.

Even though solar can increase home value by $15,000 or more, that extra value won’t cost you anything in taxes until you sell the property.

For most homeowners, this exemption applies automatically—county assessors get notified when a permit is pulled for solar installation, so there’s no extra paperwork.

How the Solar Tax Credit Works

The solar tax credit is a one-time reduction in your federal income tax bill. Officially called the Investment Tax Credit (ITC), it covers 30% of your system’s installation cost. So if your solar project costs $20,000, you could get a $6,000 credit when you file your taxes.

Unlike the property tax exemption, this credit isn’t automatic—you have to claim it on your tax return. If your federal tax bill isn’t high enough to use the full amount in one year, you can roll over the remainder to the following year.

California used to have a state solar tax credit, but it ended in 2005, so homeowners today rely on the federal ITC and the property tax exemption for savings.

How to Maximize Both Incentives

The best way to take advantage of both incentives? Use the solar tax credit to cut down your upfront costs, then let the property tax exemption keep your tax bill low for as long as you own your home.

One saves you money now. The other keeps saving you money later.

Future of California’s Solar Tax Exemptions and Incentives

So, what happens after January 1, 2027? That’s the big question. Right now, California’s Active Solar Energy System Exclusion keeps solar installations from increasing property taxes. But will lawmakers extend it again? That’s not guaranteed.

California has long championed renewable energy, and extending solar incentives aligns with its clean energy goals. The state has set ambitious targets—like reaching 100% clean electricity by 2045—so continuing tax breaks for solar installations would make sense. But things are getting complicated.

When Governor Gavin Newsom signed Senate Bill 1340 (SB 1340) in 2022, which extended the exemption through 2027, he made it clear: future extensions should consider the impact on local tax revenue. Property taxes fund schools, fire departments, and city infrastructure. By keeping solar systems off the tax rolls, counties lose out on potential revenue. Some local governments have already expressed concerns that other property owners end up shouldering the financial burden.

There’s also the argument that the exemption has done its job. Solar adoption in California is at an all-time high—millions of homeowners have already installed systems, and solar is becoming more accessible every year. Lawmakers may decide that tax incentives are no longer necessary to keep growth strong.

That’s the big question. Historically, the answer has been yes—multiple times. But the landscape is shifting.

When Governor Newsom signed the most recent extension, Senate Bill 1340 (SB 1340), he added a notable warning: “This policy has a direct impact on property tax revenues that support essential services at the local level.” Essentially, cities and counties rely on property taxes for funding schools, emergency services, and infrastructure.

By keeping solar systems tax-exempt, the state is reducing the property tax revenue that would normally be collected from homeowners with upgraded properties.

Some legislators have already started working on an extension. Senator Catherine Blakespear recently introduced a bill to extend the solar property tax exemption beyond 2027, recognizing its importance in encouraging clean energy adoption. However, the future of the exemption remains uncertain. With growing concerns about local tax revenues and shifting policy priorities, there’s no guarantee that another extension will pass.

If you’re considering going solar, waiting could be risky—securing the exemption before the deadline ensures you lock in tax savings while they’re still available.

For homeowners looking for current solar incentives and financing options, the Go Solar FAQs from the County of San Diego is a great place to start. It breaks down financing, contractor requirements, and how solar property tax exclusions work.

Does Solar Increase Property Taxes in California?

Nope. And that’s exactly why this exemption is so valuable. Normally, when you upgrade a home—adding a second story, remodeling the kitchen, or building a new garage—your property value goes up, and so do your taxes. But solar? It’s different.

Here’s how it works:

- Installing solar increases your home’s value. A system can add $15,000 or more to a property’s worth.

- But the taxman ignores it. Thanks to California’s Active Solar Energy System Exclusion, your assessed value doesn’t change, so your property taxes stay the same.

- The exemption only applies to the solar system. If you make other home improvements—like a kitchen renovation or a new deck—those can still trigger a reassessment.

This benefit lasts as long as you own the home. However, once the property changes hands, the new owner will see the full value of the solar system included in their property tax assessment. That means if you’re buying a home with an existing solar installation, you may need to account for a slightly higher assessed value.

If you’re navigating the process—especially if you’re buying a home with solar—you’ll want to know how to properly claim the exemption. The New Construction Reassessment Exclusions guide from the County of Fresno Assessor’s Office explains how the exclusion applies, what qualifies, and what forms you may need to file.

For now, as long as the exemption remains in place, California homeowners won’t see a tax hike from going solar. But with 2027 approaching, it’s worth keeping an eye on future legislation. If you’re thinking about installing solar, getting in before the deadline ensures you can take full advantage of the savings while they’re still available.